By Nikos Askitas and Ingo Isphording

The IZA/Fable SWIPE Consumption Index, a monthly measure of private consumption trends in Germany based on credit card transactions, shows a flash value of 6.34% year-on-year growth for November 2024, continuing a string of positive readings. This preliminary estimate offers an early insight into actual consumption behavior and is informed daily by fresh incoming data. It can be tracked via our embeddable, interactive graph shown below.

Clear insights needed

Understanding household economic behavior—particularly spending and consumption patterns—is crucial for both policymakers and business leaders. Private consumption accounts for over 50% of German GDP, making it a key indicator for tracking economic resilience, overheating, or potential recessions. It also serves as a foundation for designing forward-looking economic and fiscal policies.

Traditionally, consumption trends have been assessed through survey-based sentiment indicators, such as the HDE-Konsumbarometer or the GfK-Konsumklimaindex, which measure consumer confidence. However, these sentiment indicators often fail to align with actual spending behaviors, as they capture perceptions and subjective expectations rather than concrete actions.

Moreover, methodological challenges—such as the sensitivity of survey-based economic sentiment to survey modalities—can further distort results. A recent example is the artificial pessimism introduced in the University of Michigan Survey of Consumer Sentiment by switching from telephone to online interviews.

Innovative approach

The IZA/Fable SWIPE Consumption Index provides objective metrics based on real spending data from credit card transactions. Complementing sentiment-based indicators, this index offers timely, reliable insights into consumption behavior. It correlates closely with Eurostat’s private expenditure data, making it a valuable tool for measuring consumption trends.

Despite Germany’s credit card penetration rate of 56.5%—ranking only 18th out of 121 countries—the index effectively captures aggregate spending patterns across a wide range of expenditure categories. This robustness is highlighted in a recent IZA discussion paper by Winfried Koeniger and his University of St.Gallen colleagues, Peter Kress and Jonas Lehmann.

Divergence between subjective and objective measures

Subjective sentiment measures and objective spending data may not always follow similar time trends. Several factors can explain this discrepancy. For instance, financial constraints or the inelastic demand for essential goods may lead households to maintain steady spending levels, even when they express pessimistic sentiment.

Additionally, more subtle behavioral phenomena can contribute to this divergence. One example is the “lipstick effect,” where consumers opt for small, affordable luxuries during economic downturns. Another is the negativity bias produced by the dynamics of news supply and demand, which can skew reported sentiment away from actual spending behavior.

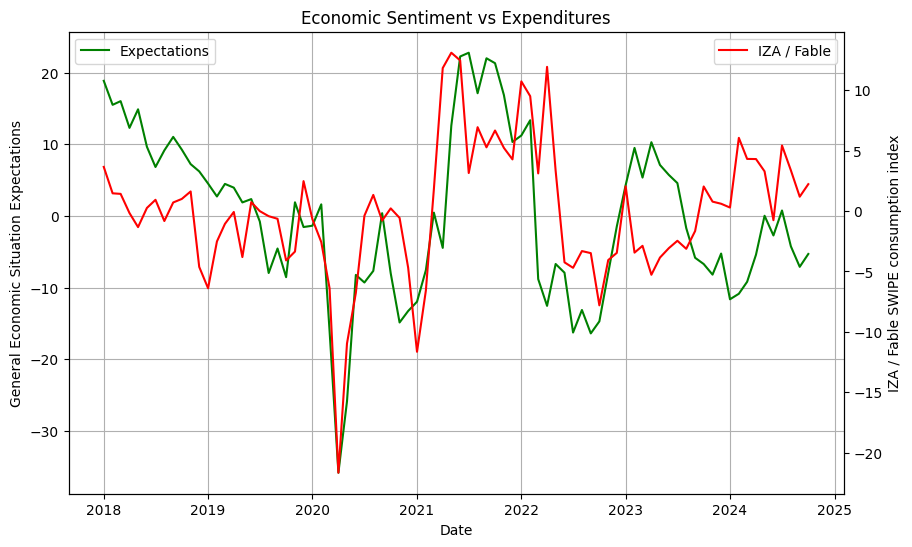

Figure 1 below illustrates the correlation dynamics of the IZA/Fable SWIPE consumption index and economic sentiment sourced from Eurostat, both adjusted for inflation. The figure highlights episodes of both decoupling and alignment between the two measures. During 2018–2019, economic sentiment steadily declined, reflecting growing pessimism, while actual spending, as captured by the SWIPE index, remained largely stable. This suggests that consumption patterns exhibited resilience despite deteriorating sentiment.

A similar divergence reemerged from early 2023 onward: while sentiment declines and stabilizes at a lower level in 2024, year-on-year consumption rates become increasingly positive in the same year. These contrasting trends, along with the broader disconnect between economic fundamentals and sentiment, may point to structural shifts in consumer behavior, the influence of financial constraints, or behavioral adaptations that sentiment indicators fail to capture.

In contrast, the period from 2020 to 2022—dominated by the pandemic, recovery efforts, and the onset of the Ukraine crisis—shows a more parallel movement of the two measures. This alignment likely reflects the heightened responsiveness of both sentiment and consumption to shared external shocks, such as fiscal interventions and global uncertainties.

Another related IZA discussion paper by Winfried Koeniger and Peter Kress provides a deeper analysis of the Fable data, illustrating how consumers responded to Germany’s temporary value-added tax (VAT) cut in 2020, implemented as a policy response to the pandemic.

Combining measures improves analysis

The patterns of divergence and convergence highlighted above underscore the importance of integrating subjective and objective measures to fully understand the interplay between consumer sentiment, actual behavior, and their impact on the business cycle. Tools like the SWIPE Index complement sentiment data, offering a more comprehensive framework for economic analysis.

Relying exclusively on sentiment-based forecasts risks underestimating the resilience of consumption. For example, Germany’s recently published third-quarter GDP growth, primarily driven by private and government consumption and described as “surprising” by the German media, closely aligned with SWIPE Index trends, which consistently indicated year-on-year growth in private spending for nearly every month of 2024. These insights from the SWIPE Index may even challenge the validity of the recently released official economic forecast for 2024.