Financial markets shape the allocation of resources in our economy. With a rapidly unraveling climate crisis and a seemingly slow-moving economic adaptation to the challenges and risks of climate change, views on how climate risks are reflected in stock prices may have important implications for sustainable investment practices.

A recent IZA discussion paper by Rob Bauer, Katrin Gödker, Paul Smeets, and Florian Zimmermann provides new insights on expert beliefs, based on a comprehensive online survey of nearly 2,000 CFA-certified finance professionals.

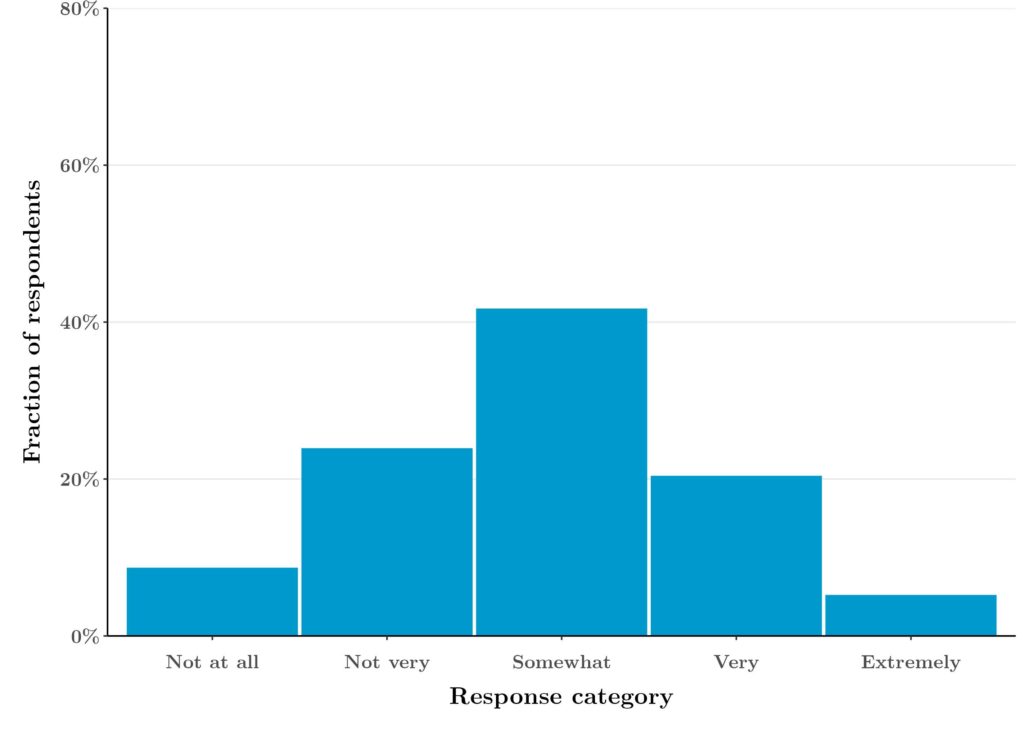

The findings reveal that the majority of financial experts (68%) believe climate risks are underpriced in the stock market, while 14% said climate risk was overpriced and only 18% found current levels adequate. However, experts are almost evenly split in their assessment of how important climate risks are for the pricing of stocks (see figure below).

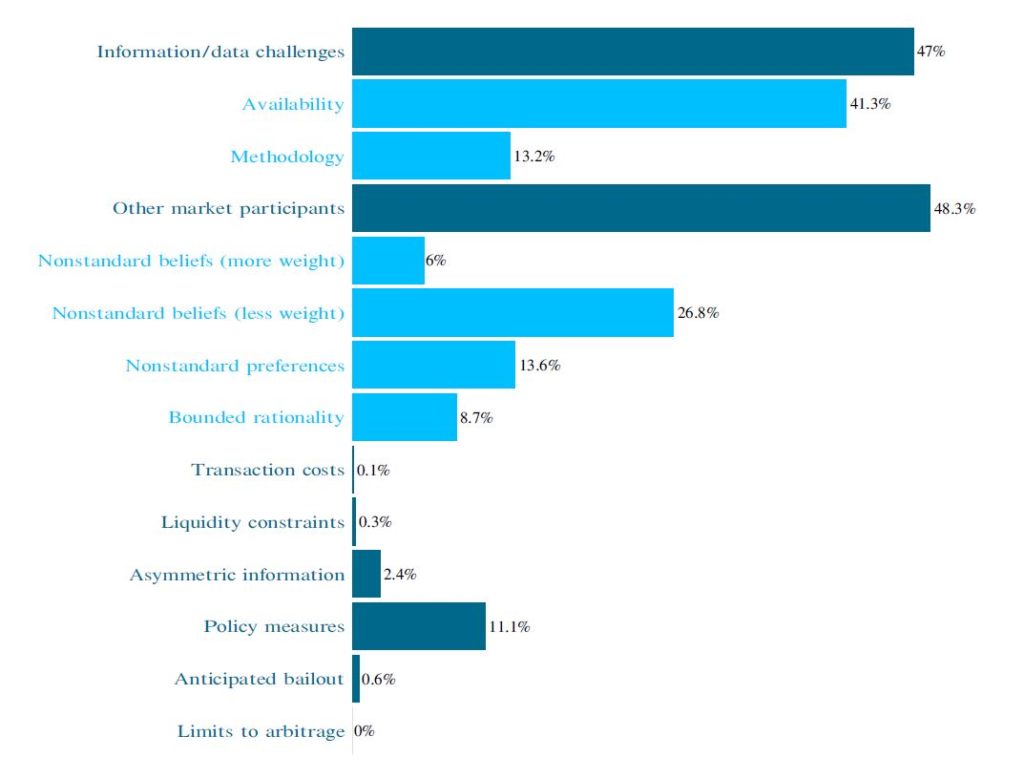

There is also significant variation in their beliefs about why mispricing of climate risks occurs and how long it will persist. The study identifies distinct mental models among the experts, which are influenced by informational constraints and second-order beliefs—how experts think other market participants perceive climate risks (see figure below).

Political orientation shapes mental models among U.S. experts

The analysis shows that these mental models significantly affect experts’ return expectations for climate-focused indices, such as the MSCI World Climate Action Index. Additionally, political leanings and geographic location were found to shape these mental models. In the U.S., left-leaning experts are more likely to believe that other market participants underestimate climate risks, while right-leaning experts often think others overstate these risks.

An experimental component of the study demonstrated that altering second-order beliefs can causally change return expectations. By providing information that shifts these beliefs, the researchers observed changes in expectations for the returns of climate-conscious indices relative to general market indices.

The empirical findings of the study underscore that the market’s ability to correct the mispricing of climate risks will remain a challenge. Most experts are rather skeptical that this can be resolved in the near future.