A recent IZA discussion paper by Charlotte Bartels, Eva Sierminska, and Carsten Schröder explores the persistent gender wealth gap in Germany, uncovering the significant role of inheritance timing in shaping wealth inequalities between men and women. The analysis, based on the German Socio-Economic Panel, provides insights into how wealth accumulation diverges across genders and life stages.

The gender wealth gap: More than earnings

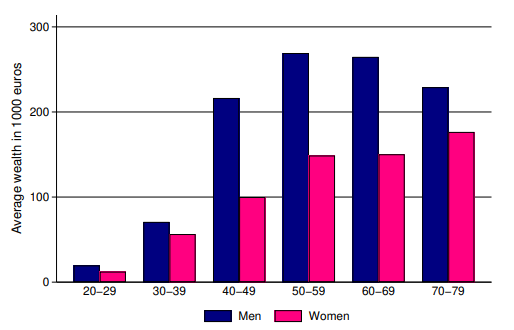

The study reveals that women, on average, possess 40% less wealth than men, a disparity magnified at the top of the wealth distribution. Among the richest 1% in Germany, women comprise less than 30% of individuals. While income and labor market participation play a role, the researchers emphasize the influence of inheritance patterns and lifetime gifts, shedding light on previously overlooked contributors to this inequality.

Timing is key: Inheritance and wealth-building opportunities

The research highlights stark differences in when men and women receive wealth transfers. Men typically inherit earlier in life, providing a critical advantage for wealth-building activities such as entrepreneurship and investment. Conversely, women often inherit later, frequently after the death of a spouse. These later-life inheritances arrive too late to drive substantial wealth accumulation during active, wealth-creating years. Consequently, the average wealth gap conceals a deeper inequality in opportunities available during the prime phases of economic productivity.

Figure: Average wealth by gender and age

“Wealth creators” vs. “wealth inheritors”

An important distinction arises between “wealth creators,” who build wealth through earnings and investments, and “wealth inheritors,” who rely on gifts and inheritances. Men dominate the “wealth creator” category, particularly at higher wealth levels, while women are more often classified as “wealth inheritors,” reflecting smaller, delayed wealth transfers.