Recently, there has been strong interest in the decline of manufacturing in the United States. Although the share in real output has been constant since the 1960s, the share in aggregate employment has been steadily decreasing over time. A popular explanation for this pattern is often attributed to labor-saving technological progress, but recent literature argues that rising trade with China has also contributed to the manufacturing decline, especially after 2000. That conclusion may, however, be specific for the US case, given the large and persistent trade deficit vis-à-vis China.

A new IZA Discussion Paper by Wolfgang Dauth, Sebastian Findeisen and Jens Suedekum focuses on this topic in the context of Germany, whose economy has a traditional focus on manufacturing and runs an overall current account surplus with relatively even trade balances with China and emerging economies in Eastern Europe. The study investigates broad sectoral employment trends between 1993 and 2014, the underlying labor transitions at the micro-level that were behind broader aggregate trends, and how this micro anatomy of structural change was affected by globalization.

Rising trade with China and Eastern Europe had heterogeneous effects

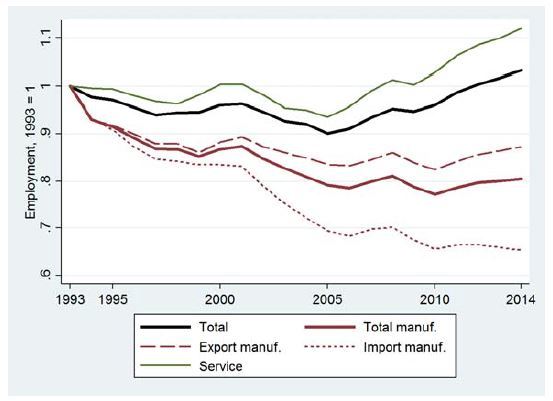

At the aggregate level, the authors observe some important compositional shifts during those 21 years. Services were on a secular upward trend, while manufacturing jobs largely declined during the first decade. But parallel to this overlying expansion of services were marked changes inside manufacturing: industries with strong increases in net import-exposure from China and Eastern Europe declined much faster than export-oriented manufacturing. The number of jobs in the latter industries has been, in fact, roughly stable since 1997, while job losses in import-competing manufacturing industries continued even after the “jobs miracle” starting in 2005.

The study also documents which labor market transitions at the individual worker level are behind those trends. This analysis conveys several novel facts about the underlying micro anatomy of sectoral employment trends. In particular, it shows that the aggregate shift from manufacturing to services does not happen smoothly. The authors find little evidence that the rise of the service economy comes from incumbent manufacturing workers who directly switch jobs. The rise is, instead, entirely driven by young entrants who exhibit different sectoral entry behaviors than previous generations and by returnees coming out of non-employment who take up jobs in different industries than their previous ones.

Without expanded trade, fewer manufacturing jobs

The second part of the study analyzes the causal impact of trade on these key labor market transitions. Dauth and his colleagues find that the long-run growth rate of manufacturing jobs would have been between 1.58 and 3.11 percentage points lower via the (re-)entry channel. In other words, as of 2014, Germany would have had between 128,000 and 259,000 fewer manufacturing jobs without the increased trade exposure from China and Eastern Europe. Because entrants and returnees would not have been pulled by the rising net export manufacturing opportunities, those jobs would, instead, have been in services (or the public/agricultural sector).

Summing up, unlike in the case of the US, rising trade with emerging low-wage countries did not speed up the decline of manufacturing in Germany. Trade, in fact, slowed it down because the rising exports to these new markets worked to stabilize industry jobs, which might have otherwise been replaced by service jobs.