In retrospect, it is often the genius inventors like Thomas Edison who get praise for humanity’s progress. Most scientists, however, would argue that it is rather the firm which serves as the cradle of groundbreaking new technologies and products. But for firms, research and development (R&D) is not a goal per se – it serves as an instrument to expand, to increase productivity and to assimilate new knowledge.

Beyond the firm itself, positive knowledge spillovers provide benefits to society as a whole. From this perspective, investments in innovation are often too small, as firms struggle to fully monetize the benefits of new ideas, and banks are not always willing to finance risky projects. Active policy is necessary to bring innovation to optimal levels.

In a new IZA discussion paper, Andreas Lichter, Max Löffler, Ingo E. Isphording, Thu-Van Nguyen, Felix Pöge and Sebastian Siegloch estimate the impact of profit taxation of German firms on the level of R&D spending and filed patents (as a proxy of innovation output). The size of this effect is immensely important for the design of tax policy, as profit taxation is an important source of revenue for many countries.

Based on a sample of nearly all R&D active firms in Germany, the authors exploit close to 7,300 local tax changes between 1987 and 2013. Each tax change is interpreted as a single natural experiment, comparing the accompanying change in R&D investment to the level of investment of plants in municipalities where taxes remained unchanged at the same time.

Higher taxes lead to lower R&D spending and fewer patents

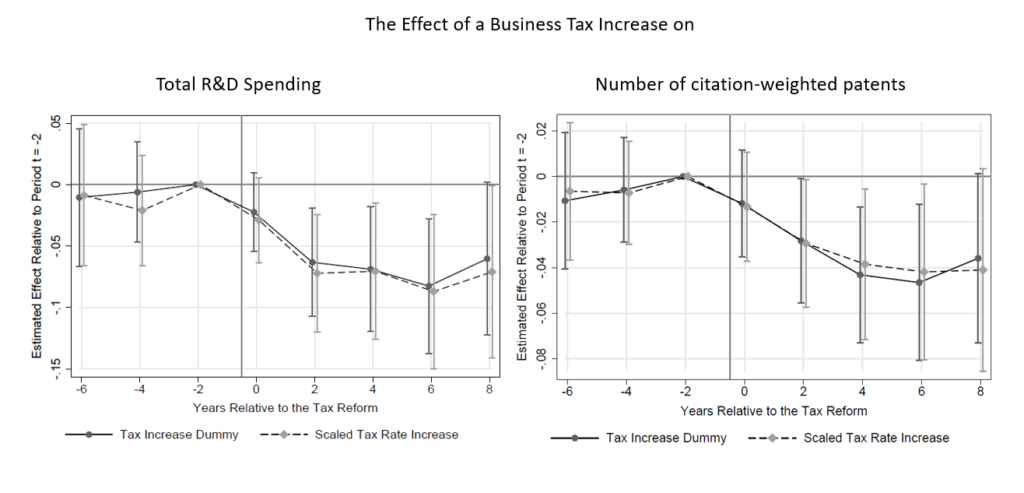

The empirical results indicate that an increase in the local business tax rate has a negative and statistically significant effect on plants’ total R&D expenditures. These reductions in R&D spending are particularly strong among young and credit-constrained firms. A similar negative effect appears about two years later in resulting patents. Despite these notable effects, the authors emphasize that reductions in business taxes are likely not the best policy response to their study’s findings. Instead, “targeted tax incentives for R&D expenditures appear to be the more efficient policy instrument altogether,” as untargeted tax changes affect both innovating and non-innovating firms.

Despite these notable effects, the authors emphasize that reductions in business taxes are likely not the best policy response to their study’s findings. Instead, “targeted tax incentives for R&D expenditures appear to be the more efficient policy instrument altogether,” as untargeted tax changes affect both innovating and non-innovating firms.

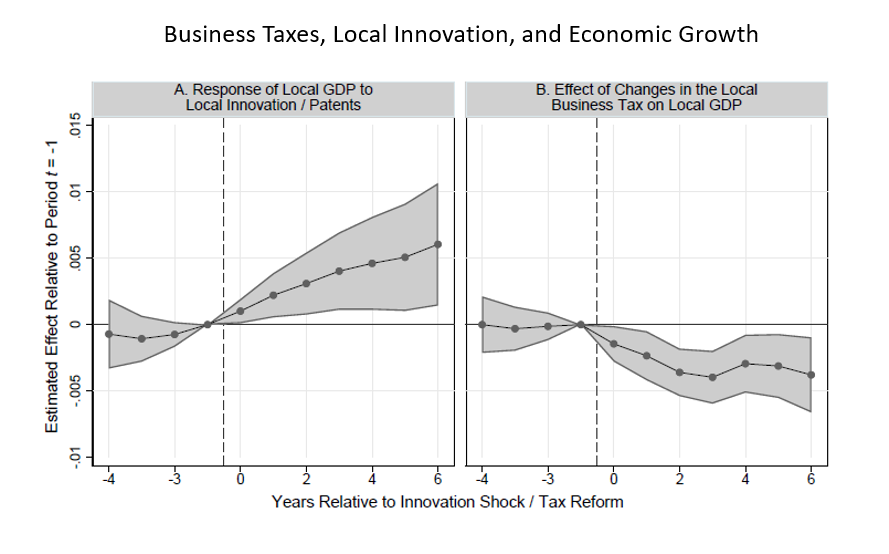

The authors also provide suggestive evidence that local innovation has a positive and lasting effect on municipal economic growth. In contrast, an increase in the local business tax considerably reduces local GDP. Combining these two pieces of evidence with the effect of taxes on innovation, they conclude that around eight percent of the total negative effect of profit taxation on local growth are due to tax-induced reductions in innovation, which highlights the important role of innovation for economic growth.