What have industrial robots done for growth and employment? IZA affiliate Georg Graetz and Guy Michaels answer this question using novel data on industrial robots in 14 different industries in 17 developed countries including Germany, Australia, South Korea, and the US, over the period 1993-2007.

What have industrial robots done for growth and employment? IZA affiliate Georg Graetz and Guy Michaels answer this question using novel data on industrial robots in 14 different industries in 17 developed countries including Germany, Australia, South Korea, and the US, over the period 1993-2007.

Their findings: Robots account for one-sixth of productivity growth on average across countries. They also account for more than a tenth of total GDP growth. And while robots do not seem to reduce overall employment, there is some evidence that they reduce the employment of low-skilled and, to a lesser extent, middle-skilled workers.

By Georg Graetz and Guy Michaels

Robots’ capacity for autonomous movement and their ability to perform an expanding set of tasks have captured writers’ imaginations for almost a century. But more recently, robots have emerged from the pages of science fiction novels into the real world, and discussions of their possible economic effects have become ubiquitous (see e.g. The Economist 2014, Brynjolfsson and McAfee 2014). However, there has so far been no systematic empirical analysis of the effects that robots are already having.

We compile a new dataset spanning 14 industries (mainly manufacturing industries, but also agriculture and utilities) in 17 developed countries (including European countries, Australia, South Korea, and the US). Uniquely, our dataset includes a measure of the use of industrial robots employed in each industry, in each of these countries, and how it has changed from 1993-2007. Our data on these robots come from the International Federation of Robotics (IFR). We obtain information on other economic performance indicators from the EUKLEMS database.

What exactly are industrial robots? The IFR considers a machine as an industrial robot if it can be programmed to perform physical, production-related tasks without the need of a human controller. Industrial robots dramatically increase the scope for replacing human labour compared to older types of machines, since they reduce the need for human intervention in automated processes. Typical applications of industrial robots include assembling, dispensing, handling, processing (for instance, cutting) and welding, all of which are prevalent in manufacturing industries; as well as harvesting (in agriculture) and inspecting of equipment and structures (common in power plants).

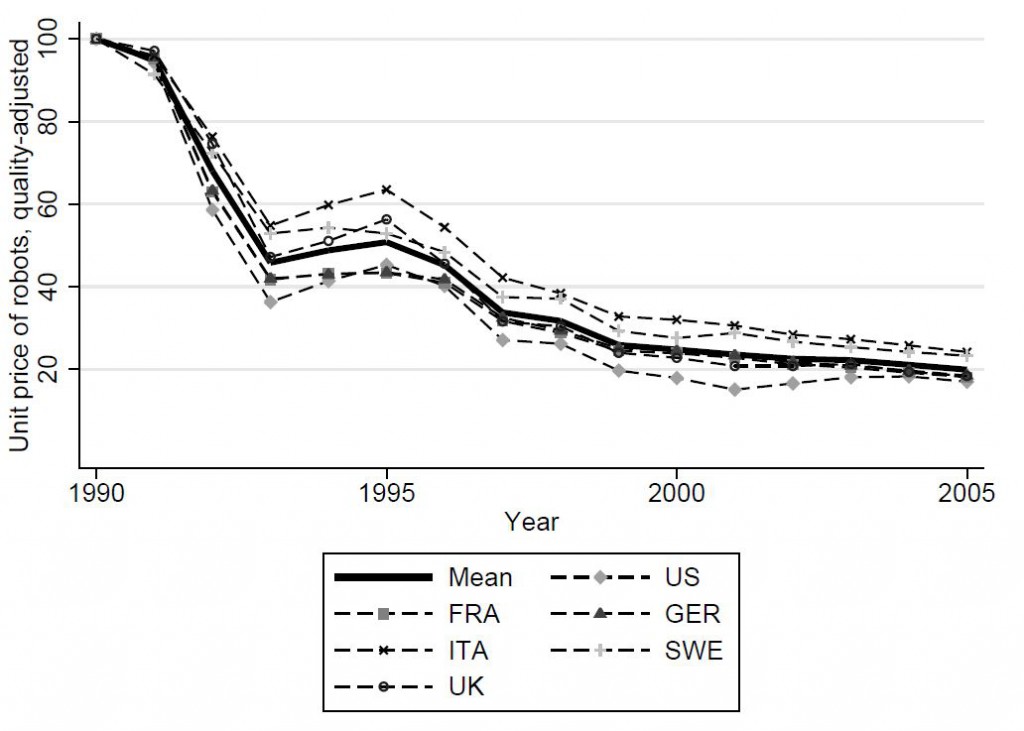

We find that after adjusting for quality, the price of industrial robots fell by about 80 percent within just a decade and a half, and their usage increased by about 150 percent. The rise in robot use was particularly pronounced in Germany, Denmark, and Italy. The industries that increased robot use most rapidly were the producers of transportation equipment, chemical industries, and metal industries.

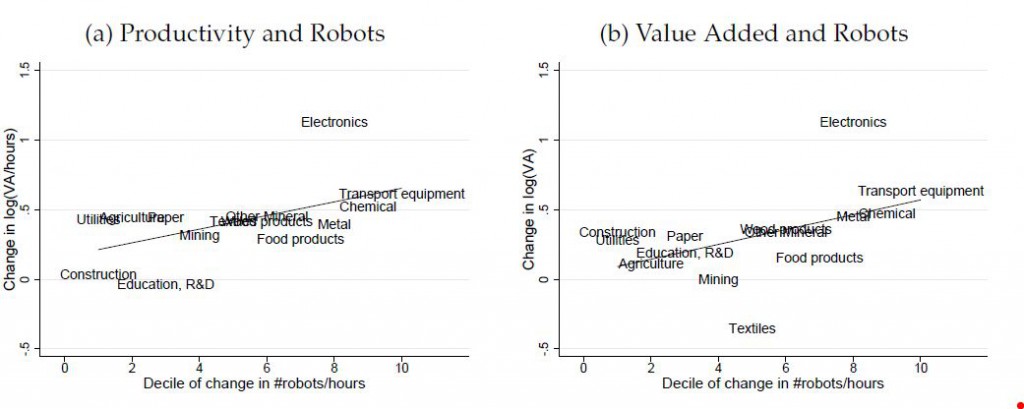

To estimate the impact of robots, we take advantage of variation across industries and countries and over time. Our OLS estimates are robust to including a large number of controls, and to measuring the use of robots in several alternative ways. A consistent picture emerges in which robots raise productivity, without causing total hours to decline.

One potential concern is that higher productivity growth might have increased robot use, rather than the other way around. To address this and related concerns, and to shed further light on the causal effect of robots, we develop a novel instrumental variable strategy. Our instrument for increased robot use is a measure of workers’ replaceability by robots, which is based on the tasks prevalent in industries before robots were widely employed. Specifically, we match data on tasks performed by industrial robots today with data on similar tasks performed by US workers in 1980, before robots were used. We then compute the fraction of each industry’s working hours in 1980 accounted for by occupations that subsequently became prone to replacement. Our industry-level “replaceability” index strongly predicts increased robot use from 1993-2007.

Applying our instrumental variable strategy, we again find that robots increased productivity, and detect no significant effect on hours worked. As an important check on the validity of this exercise, we find no significant relationship between replaceability and productivity growth in the period before the adoption of robots.

We conservatively calculate that on average, the increased use of robots contributed about 0.37 percentage points to the annual growth of GDP, which accounts for more than one tenth of total GDP growth over this period. The contribution to labor productivity growth was about 0.36 percentage points, accounting for one sixth of labor productivity growth. This makes robots’ contribution to the aggregate economy roughly on par with previous important technologies, such as the railroads in the nineteenth century (Crafts 2004) and the US highways in the twentieth century (Fernald 1999). The effects are also fairly comparable to the recent contributions of information and communication technologies (ICT, see e.g. O’Mahoney and Timmer 2009). But it is worth noting that robots make up just over two percent of capital, which is much less than previous technological drivers of growth.

While we do not find evidence of a negative impact of robots on aggregate employment, we see a more nuanced picture when we break down employment (and the wage bill) by skill groups. Robots appear to reduce the hours and the wage bills of low-skilled workers, and to a lesser extent also of middle skilled workers. They have no significant effect on the employment of high-skilled workers. This pattern differs from the effect that recent work has found for ICT, which seems to benefit high-skilled workers at the expense of middle-skilled workers (Autor 2014, Michaels et al. 2014).

In further results, we find that industrial robots increased total factor productivity and wages. At the same time, we find no significant effect of these robots on the labor share.

As of 2007 industrial robots penetrated only a limited part of the developed economies that we examine. If the quality-adjusted prices of robots keep falling at a rate similar to that observed over the past decades, and as new applications are developed (especially in the services industries), there is every reason to believe that robots will continue to increase labor productivity. This suggests that some of the recent concerns about a possible slowdown in productivity growth (e.g. Gordon 2012, 2014) may be overly pessimistic. Our findings do, however, come with a note of caution: there is some evidence of diminishing marginal returns to robot use, or congestion effects, so robots are not a panacea for growth. Moreover, the rise of robots is not a blessing for all, given that low-skilled and middle-skilled workers may lose out.

References and further reading

AUTOR, D. H. (2014): “Polanyi’s Paradox and the Shape of Employment Growth,” NBER Working Papers 20485, National Bureau of Economic Research, Inc.

BRYNJOLFSSON, E., AND A. MCAFEE (2014): The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies. W.W. Norton & Company.

CRAFTS, N. (2004): “Steam as a General Purpose Technology: A Growth Accounting Perspective,” The Economic Journal, 114(495), pp. 338–351.

THE ECONOMIST (2014): “Rise of the robots”, March 29th.

FERNALD, J. G. (1999): “Roads to Prosperity? Assessing the Link between Public Capital and Productivity,” American Economic Review, 89(3), 619–638.

GORDON, R. J. (2012): “Is U.S. Economic Growth Over? Faltering Innovation Confronts the Six Headwinds,” NBER Working Papers 18315, National Bureau of Economic Research, Inc.

GORDON, R. J. (2014): “The Demise of U.S. Economic Growth: Restatement, Rebuttal, and Reflections,” NBER Working Papers 19895, National Bureau of Economic Research, Inc.

GRAETZ, GEORG, AND MICHAELS, GUY (2015): ”Robots at Work”, IZA Discussion Paper No. 8938.

MICHAELS, G., A. NATRAJ, AND J. VAN REENEN (2014): “Has ICT Polarized Skill Demand? Evidence from Eleven Countries over Twenty-Five Years,” The Review of Economics and Statistics, 96(1), 60–77.

O’MAHONY, M., AND M. P. TIMMER (2009): “Output, Input and Productivity Measures at the Industry Level: The EU KLEMS Database,” Economic Journal, 119(538), F374–F403.

photo credit: Maksim Dubinsky via Shutterstock